Local Incentive Programs

Upper Shore Workforce Investment Board Incumbent Worker Training Fund (IWT)

The Incumbent Worker Training Fund offers training support to businesses in Queen Anne’s County with a plan or an interest in training their current working individuals. The applicants must not be contractual employees. All trainings must result in a credential that confirms completion.

Training expenses will be a maximum of $5,000 per company, with a targeted training rate of $1,500 per individual, though the targeted rate per individual is negotiable.

Apply

Learn more about the Upper Shore Workforce Investment Board Incumbent Worker Training Fund (IWT) HERE.

Economic Development Incentive Fund (EDIF)

Available to individuals/businesses interested in starting a new business, expanding an existing business, or relocating operations to Queen Anne’s County.

Strong consideration is given to those businesses that fall within the following industry profiles: Advanced Manufacturing, Agriculture and Seafood, Technology, or Hospitality/Tourism.

Projects must demonstrate significant economic impact. Examples include job creation and retention, increase in production, and/or potential for a niche market. They must also be consistent with the County’s development land use goals, and economic development priorities. The business must be physically located within the geographic boundaries of Queen Anne’s County, although residency is not required of the business owner(s).

Applicants must provide a demonstrated need for the funding. Request for funding through this program are reviewed at the sole discretion of the Queen Anne’s County Economic Development Incentive Fund Commission, with disbursement authorization by the County Commissioners, as program funding is available.

Apply

Applications may be submitted online using the button link below, or download the paper application (PDF).

Questions? Please contact us.

Revolving Loan Fund (RLF)

New and expanding businesses located in the county are eligible to apply for low interest loans. The fund provides access to capital for business development, start-up, strategic expansion and for vineyard establishment.

Requests for funding through this program are reviewed at the sole discretion of the Economic Development Commission, with disbursement authorization by the County Commissioners, as program funding is available.

Loan amounts range from $50,000 to $100,000 and can be used for real estate acquisition and/or improvements, equipment, and working capital associated with the project.

Funds can be used to leverage conventional loans or loans from intermediary lenders such as Maryland Capital Enterprises, The VOLT Fund, and Maryland Agricultural Resource Based Industry Development Corporation (MARBIDCO).

Info

For information about availability, please contact us.

Commercial Property Tax Credit

The county offers eligible businesses, located outside of the QAC Enterprise Zone a property tax credit.

To be eligible the property investment needs to be $25,000 or more in real property improvements, and a minimum of 12 new full-time jobs are created within two years as a result of the project.

The credit is prorated over four years against the increased assessed value at 80% (Year 1), 60% (Year 2), 40% (Year 3) and 20% (Year 4).

The tax credit is awarded at the discretion of the County Commissioners.

Apply

To apply for consideration, download and complete the attached application.

Property Assessed Clean Energy (PACE)

Queen Anne’s County adopted the PACE program to allow businesses to access up-front financing for energy-efficient improvements on commercial properties.

C-PACE is the acronym for Commercial Property Assessed Clean Energy. It is a simple and effective way for local communities to create jobs, retain businesses, and keep dollars in the local economy without raising taxes – simply by helping to make commercial buildings more energy-efficient.

Payments are made as a surcharge on the tax bill, and transfer with property ownership.

For more information, visit the MD-PACE website.

Fact Sheet

Read the Fact Sheet about the Maryland PACE program.

Workforce & Career Development

Queen Anne’s County recently added a new career technology liaison position within the department dedicated to developing internships and apprenticeships for youth among local industries. The program kicked off officially in the Fall of 2021.

Mission: Support opportunities for youth on-the-job training & experiences, especially those in technology and trade industries. Connect local businesses with a local youth workforce.

More

Learn more about what Queen Anne’s County is doing to support the development of its workforce and supporting youth career development in manufacturing, culinary, trades, and beyond.

Upper Shore Micro Ag Grant

The Upper Shore Regional Council periodically offers funding supporting a local Queen Anne’s County Micro Ag Grant. Grant funding can be used for strategic marketing campaigns, technology innovation or implementation, capital improvements for business expansion or value added production, research projects, animal welfare improvements.

Apply

Read more about the grant requirements and how to apply.

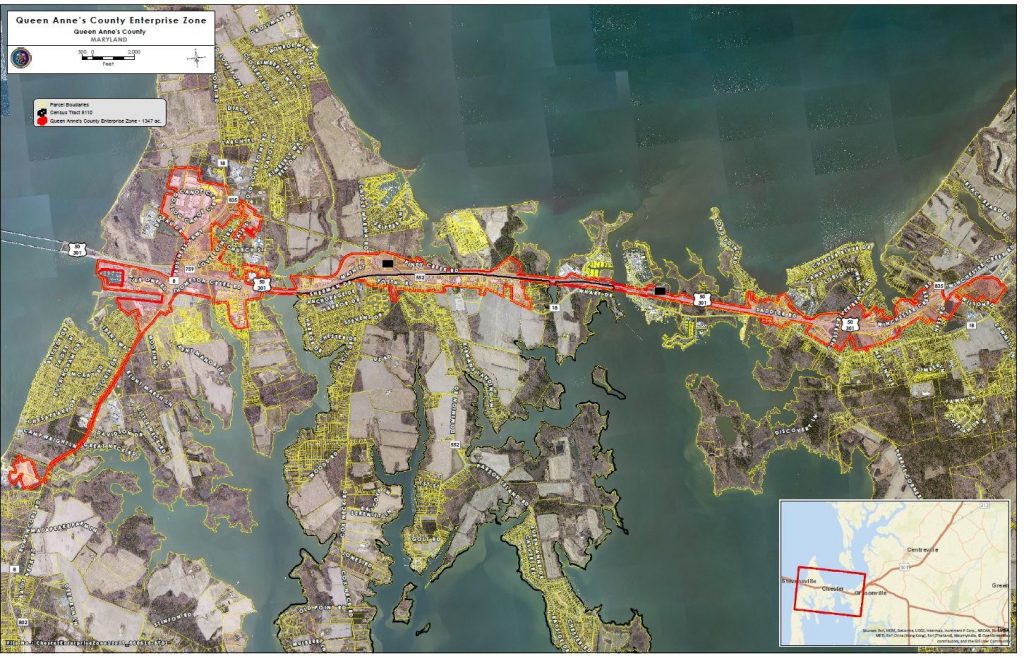

Business Zones

Enterprise Zone

A geographically designated area wherein investments in commercial development and redevelopment and job creation are eligible to receive tax credits.

To see if a property is within the designated Enterprise Zone, View the Enterprize Zone Interactive Map

This zone includes a majority of the Planned Growth Areas of Grasonville, Chester, and Stevensville, including the Chesapeake Bay Business Park, Matapeake Professional Park, and the Thompson Creek area.

Infrastructure exists to support new, infill, and redevelopment of commercial property.

Eligible commercial projects within the Enterprise Zone can be certified to receive a commercial real property tax credit prorated over 10 years.

Eligible businesses operating within the Enterprise Zone can receive income tax credits for the creation of full-time jobs.

The following uses are not eligible: fast-food restaurants, convenience stores, stand-alone gas stations, adult entertainment, and gambling facilities.

Apply

Complete the application for either the real property or income tax credit.

About the Enterprise Zone Commercial Real Property Tax Credit

A ten (10) year credit against local property taxes is available to companies that locate, expand, or substantially improve business properties within the Enterprise Zone.

The property tax credit is equal to 80% of the difference between the base value of the property (the assessment in the year prior to new construction, expansion, or substantial improvement) and the newly assessed value of the property after the investment is made.

The property tax credit is 80% for five years. During the last five years, the property tax credit declines 10% annually; the credit is 70%, 60%, 50%, 40%, and 30% respectively. This tax credit is administered to the property owner in their Property Taxes.

Eligibility Requirements:

- In order to receive a property tax credit for the next taxable year (beginning on July 1 when the tax bill is issued), the local Zone Administrator, the Queen Anne’s Department of Economic Development, must certify to the MD Department of Assessments and Taxation (SDAT) the eligibility of a particular business by no later than the end of the preceding calendar year on December 31st.

- The granting of an Enterprise Zone property tax credit is affected by the timing of the completion of capital improvements, the assessment cycle, and how the improvements are assessed. (I.E. the improvement must change the value of the real property);

- The law states that the credit shall be granted to the “owner” of qualified property. In cases where a lessee makes the capital improvements, the lessees should make a contractual provision with the owner of the qualified property regarding receipt of the property tax credit.

About the Enterprise Zone Income Tax Credit

There are two types of Enterprise Zone income tax credits. If the employee is not economically disadvantaged, you may qualify for a one-time credit of $1,000 per employee. If the employee is economically disadvantaged, as determined by the Maryland Jobs Service, you may take a credit up to $3,000 of the employee’s wages in the first year of employment. The credit is $2,000 in the second year and $1,000 in the third. DLLR must certify that the employee is economically disadvantaged.

Please refer to the DLLR website for the criteria. A voucher must be submitted to DLLR within 28 to 30 days of hiring a disadvantaged worker.

This credit can be stacked with other job creation-based credits including the Job Creation Tax Credit (JCTC), More Jobs for Marylanders (MJM), etc.

Once/if a business has been certified, the credits can be claimed upon filing a Tax Return using Form 500CR and a copy of the Certification Letter.

Eligibility Requirements:

- There is no minimum on the number of employees to meet the necessary qualifications.

- Must have been hired after the date on which the Enterprise Zone was designated or the date on which the business relocated in the Enterprise Zone, whichever is later.

- Must be filling a new position or replacing an employee who was previously certified as economically disadvantaged.

- Must have been employed at least 35 hours a week for at least six months.

- Must be paid at least 150% of the federal minimum wage throughout his or her employment by a business entity before or during the taxable year for which the entity claims a credit.

- Must have spent at least half of his or her working hours in the Enterprise Zone or on activities directly resulting from the business location in the zone.

- Must be a new employee or an employee rehired after being laid off by the business for more than one year.

Help

To take advantage of these Enterprize Zone Tax Credits, please contact us.

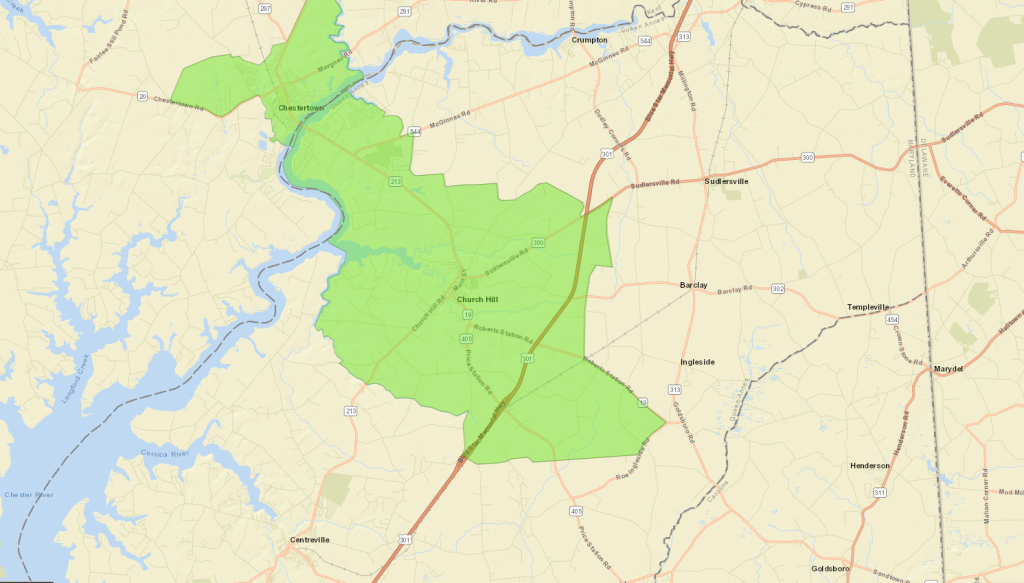

Opportunity Zone

Queen Anne’s County Opportunity Zone is Census Tract 24035810300 which is designated to receive private investments through opportunity funds.

It is located in the Church Hill area of the county and connects with major transportation routes Rt. 301 and Rt. 213.

Opportunity funds are certified by the Treasury to aggregate and deploy capital for eligible users defined as Opportunity Zone Property.

MORE INFORMATION:

DHCD / Maryland Opportunity Zones

View the Queen Anne’s County Opportunity Zone on the Maryland Opportunity Zone Interactive Map

Foreign Trade Zone

Queen Anne’s County is within the service area of the Baltimore No. 74 Foreign Trade Zone (FTZ). Baltimore FTZ #74 was established in 1982 and has been continually expanded and modified due to various requests for additional space.

Zone space, originally 60,000 square feet, currently includes more than 900 activated acres at multiple sites in the Baltimore-Towson MSA.

In 2017 the Zone served 193 businesses employing 659 people. Over $11.3 billion worth of goods were transferred to U.S. Customs’ Territory and $397 million in merchandise was exported from the FTZ to international markets.

Arts and Entertainment District

District Related Tax Credits:

Qualifying businesses located in the Historic Stevensville A & E District can apply for and receive tax credits from amusement and admissions tax, and sales and use taxes.

A real property tax credit is available for renovations or new construction that creates space capable of use by qualifying arts use. Examples include artist studios, recording studios, art galleries, performance venues, and more.

Job Creation Tax Credit

The State of Maryland, through the Department of Commerce, offers a Job Creation Tax Credit (JCTC) for companies within specific industries creating new jobs.

The business facility must be certified as having created a minimum number of qualified positions. Companies must declare intent prior to any job creation.

Additional Resources:

For more information about this and other employment-based job credits, click here.

For a complete list of tax credits for businesses, including More Jobs for Marylanders, click here.

Locate Here

Interested in exploring locations in Queen Anne’s County?

Explore the interactive site selector which showcases locations for lease or sale in our local area. Contact us for additional information.

Partnerships

Interested in learning more about partner agencies and programs?

View our webpage that lists and describes various agencies dedicated to supporting business in our community.